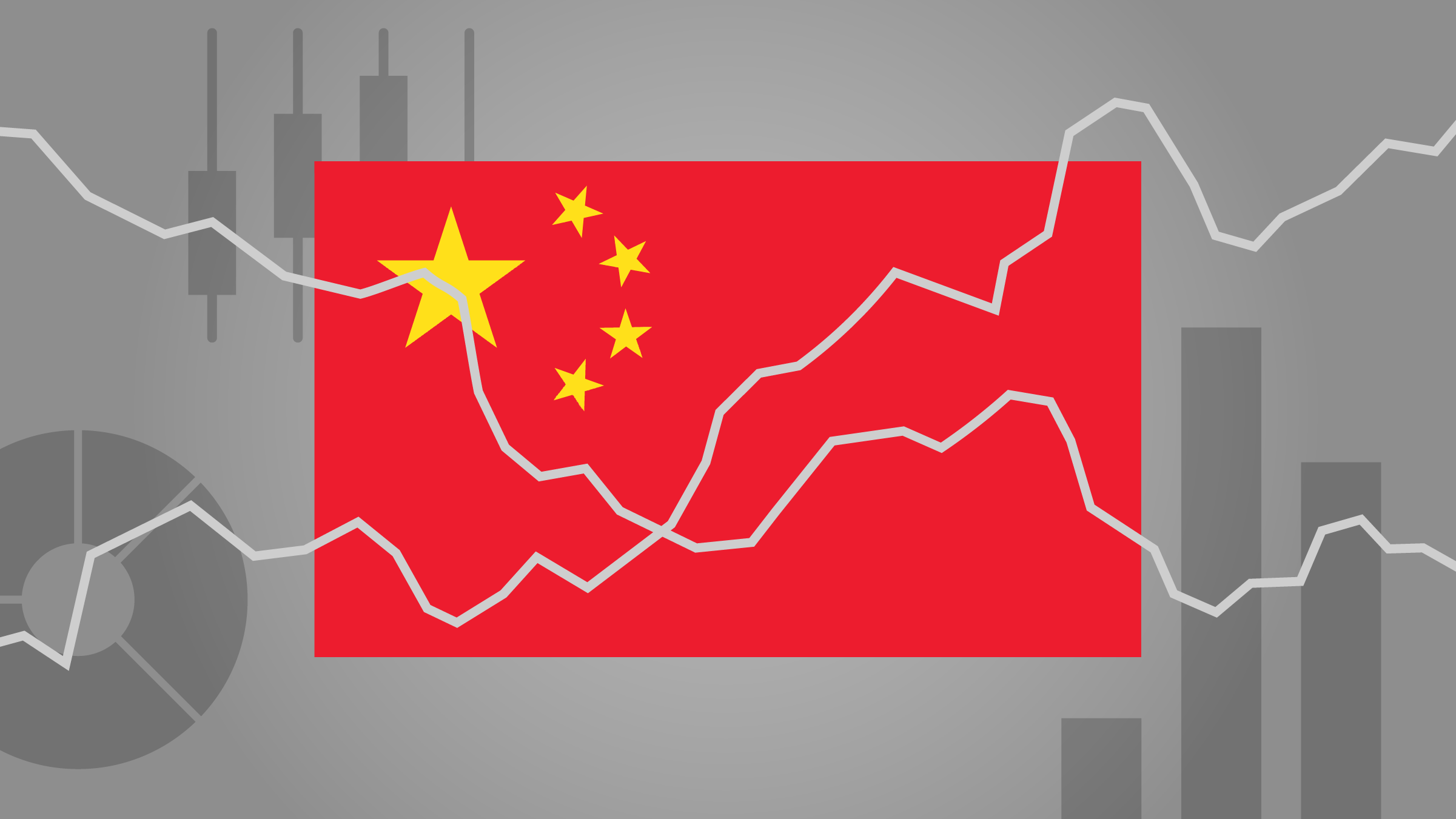

Unfortunately, credit growth stalled out in the second quarter, and we believe it will remain so, signaling flat economic growth for the rest of this year. Meanwhile, the trade war impact is still looming, with the average U.S. tariff rate on China set to surge to 17.5% pending the September implementation of the recently ordered tariffs on all of the remaining untargeted imports, sending China's currency into steep depreciation so far in August.

The following article is a summary of the full report, “China's Economy in the Doldrums as Trade War Impact Looms--China Diagnostics: Second-Quarter 2019” which is available to Morningstar Direct clients here. Direct clients can also explore our April report, “Are China and the U.S. Headed for a New Cold War?” available here.

Key Takeaways

- Official real GDP growth fell to 6.2% in the second quarter from 6.4% in the first, but our alternative broad proxy actually ticked up to 5.8% from 5.4%. A second-quarter rebound is logical, given that credit growth began increasing in January plus the typical one- to two-quarter lag.

- Trade hasn't been a major drag on China's economy yet, and even its trade balance with the United States stabilized in the second quarter. However, the May and (recently ordered) September U.S. tariff hikes will send the average U.S.-China tariff rate surging to 17.5% by the fourth quarter (see the first exhibit).

- Fixed-asset investment growth has remained stable, with growth in stimulus-backed infrastructure spending offset by continued manufacturing investment weakness, likely due to trade war worries.

- After bouncing back in the first quarter, credit growth was flat in the second quarter. We don't think the government is targeting a full credit-driven recovery, owing to China's already very high debt load.

Despite Officially Reported Drop, Growth May Have Recovered Slightly in the Second Quarter

China's official real GDP growth fell to 6.2% in the second quarter from 6.4%. However, our alternative broad proxy actually increased to a 5.8% growth rate after hovering around 5.4% to 5.6% in the prior three quarters (Exhibit 2a). The timing of a second-quarter growth rebound is logical—credit growth began increasing in January from trough levels, and economic growth typically follows credit with a one- to two-quarter lag. We think the official GDP figures have missed both the timing and the magnitude of China's slowdown. Regarding timing, we think that growth began slowing at the end of 2017 following a credit slowdown. Quite plausibly, China deferred recognition of its economic slowdown until the end of 2018 in order to use the U.S.-China trade war as a scapegoat for slower growth.

China's march to deleveraging has ended for now, but the gap between credit growth and nominal GDP growth has stabilized.

Declining net imports from Asian trading partners likely reflects temporary improvement as China curtails imports of intermediate inputs in preparation for a decline in U.S. exports. So far, China has not had to sell off meaningful amounts of its foreign currency reserves (Exhibit 2h). This is in part because capital outflows have been modest, but also because China has been more flexible in allowing its currency to depreciate: In early August the yuan-dollar exchange rate crossed 7 for the first time since 2008.

Total Social Financing Growth Flat in 2Q After Rebound in Previous Quarter

Over the second quarter, the People's Bank of China continued to inject liquidity and roll out policies to encourage financing to small and midsize enterprises, with a visible impact on interbank rates. However, the impact of credit has been underwhelming: Our adjusted total social financing, or TSF, measure remained flat from the previous quarter at 11.4% year-over-year growth, despite the prior quarter's bounceback from trough growth of 10.3% in December. Flat credit growth fell in line with our prediction that credit growth would remain at 11% to 12% in 2019—providing a sufficient boost to stabilize the economy but not create a full recovery (as occurred in the 2013 and 2016 easing cycles).

On the one hand, government bond growth remained high (at about 20%), and the decline in shadow banking lending decelerated from negative 10% to negative 8%. However, this was fully offset by a contraction in loan growth to 8% from 8.3% in the prior quarter. Household loan growth slowed slightly, particularly for short-term loans, as banks have become wary of rising credit card loan risk after rapid expansion over the past six years. However, the primary driver of slower loan growth has been a pullback in nonfinancial enterprise borrowing to a 11.2% growth rate from 11.9% in March. While corporates have redirected some of their borrowing to the bond market, this hasn't fully offset falling loan growth. Although rates have fallen over the past 18 months, credit spreads remain high, helping explain why we haven't seen a surge in bond borrowing as occurred in the 2016 easing cycle.

Corporate debt/GDP looks to increase to around 171% in 2019, and we also forecast increases in household debt to 55%. As a result, we estimate overall credit/GDP will approach 266% at the end of 2019, so China is not yet deleveraging.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/347BSP2KJNBCLKVD7DGXSFLDLU.jpg)