Alex Bryan: For Morningstar, I'm Alex Bryan. We're on the sidelines of the Morningstar Investment Conference. Today, we had a discussion about defensive equity strategies. One of the members of that panel is Darby Nielson, who is the managing director at Fidelity, where he manages a team of quant and technical researchers.

Darby, thank you so much for joining us.

Darby Nielson: Absolutely. My pleasure.

Bryan: Darby, what is the case for owning low-volatility or defensive equity stocks? Why not just adopt a more conservative asset allocation?

Nielson: The case for low-volatility investing is that you get equitylike returns but ideally with lower risk, lower volatility; you get some downside protection; and because you get those things, you should get better risk-adjusted returns. That's the case for it.

As far as a more conservative asset allocation, certainly, an option. I do think that if you are investing over the longer cycle, investing for the long term, then if your allocation is more to cash or bonds, you're probably going to get lower returns from what you would get from an equity strategy.

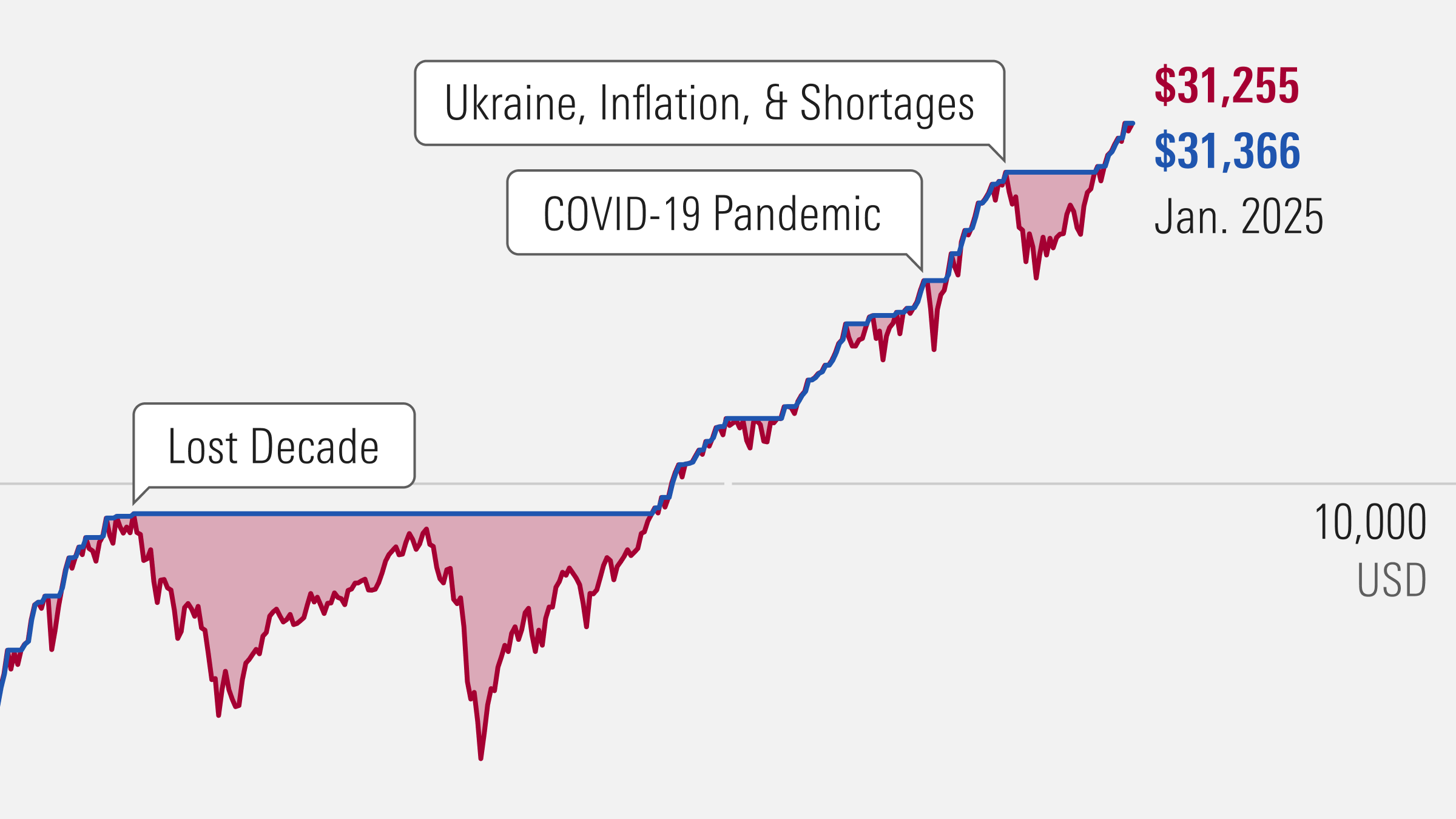

Also, I think, to answer this question, it helps to think about why low-volatility investing is effective. I said it's an equitylike strategy, you get equitylike returns. Typically, lower beta. But if it's constructed properly, you should get some downside protection as I talked about. If the market goes down, presumably the low-vol strategy should go down a little less. The compounding effect that you get from that going on is over time really going to add a lot of benefit. It's that math that we learned about where if you lose 50% of your wealth, you have to make 100% return to get it all back. For a low-vol strategy, they can outperform when the market goes down. I think that that benefit of compounding can really add value and that's part of the case for low-volatility investing.

Bryan: Right. Of course, Fidelity has a low-volatility ETF, Fidelity Low Volatility Factor, which basically takes a sector-relative approach to low volatility where you rank all the stocks in each sector based on their volatility over the past several years and then target the least volatile stocks within each sector. Can you talk about the benefits of that sector-relative approach to stock selection?

Nielson: Yes, absolutely. I think it goes back to a couple of years ago when we started thinking about what these should be. I thought about, what are the three objectives we are tying to accomplish with these ETFs. And to me, at that time, they were targeted exposure--if you buy a value product, you should get cheap stocks. Number two, and this is key, reducing unintended exposures. If you buy a low-vol product, it isn't mid-cap or small-cap in disguise or 30% or 40% utilities. The third objective is competitive performance.

Along the lines of the second objective of reducing unintended exposures, which I think is a key, key component of what we are doing in our construction process, that's why we are using this sector-relative approach, so that therefore in FDLO, which is our low-volatility ETF, you are not going to get, like I said, a 40% utilities bet. And we are, I should say, using a ranking approach, as you talked about. We are ranking stocks by trailing volatility. However, we are also looking at the beta of the stocks. A third component we use to rank stocks is the variability of earnings, a fundamental volatility, which we found was another good measure in the product partially because we at Fidelity believe stocks follow earnings and having some sort of fundamental volatility was helpful.

But when you put all these pieces together and then sector-neutralize, it's another way to control the unintended exposure that you might get in some other products. Reducing those to me was a key objective.

Bryan: One of the interesting choices behind this product is you are looking at volatility over the last five years, right, whereas some of your competitors use a shorter look-back window. Can you talk about what you decided to measure volatility over the last five years and what some of the trade-offs there might be?

Nielson: Some might argue or think that if you use a one-year or a three-year versus a five-year, you are going to get a more updated measure or gauge of volatility and presumably, that should give you lower volatility in the product over time. To be honest, we've done some of that research and from what we've seen at least, on our team, is that if you go from one to three, maybe you get a little lower volatility, but it's marginal. It's an incremental improvement. And the trade-off is you get more turnover.

We had to think about what sort of window do we want to look at to measure volatility, still balance the turnover, and frankly, whether it's one, three or five, we found pretty similar volatility in the products. That's the goal of a low-volatility product is you get low volatility relative to the broad equity market and protection on the downside.

Bryan: Right. And you are trying to implement that in the most cost-efficient manner by turnover?

Nielson: That's right.

Bryan: Makes sense. Now, Research Affiliates a couple of years ago, put up some work suggesting that low-volatility stocks are trading at higher valuations today than they have historically. To what extent are you concerned about valuations of these low-volatility strategies? Is that something on your mind?

Nielson: It's on my mind and I'm somewhat concerned, I guess, I would say. The reason for that is twofold. One is that we have done plenty of research to look at the valuations of factors including low-vol and whether or not that tells you anything about the subsequent performance. As it turns out, it kind of does.

On the other hand, it's extremely difficult to do. It's not something people should really do look at the valuations because it's just hard to time the factors frankly. Having said that, it is a little expensive. We look at that kind of thing frequently for all of our products, all of our factors. I looked at it recently. It's not as expensive as it was, particularly, in the summer of '16 when rates were at their bottom. Or even, I think, nine to 12 months ago, when the strategies were quite expensive.

It seems like valuations matter to some degree, although it's hard to get the timing right. And two, it does seem like it's a little expensive. On the other hand, like I said, it's hard to time it right. I am a believer in the longer term of low-volatility strategies for the reasons I listed before. There's some concern, but I still believe in it.

Bryan: If you are a more conservative investor, it makes sense to stay the course despite where valuations are?

Nielson: Yes. That was my point about the longer cycle not necessarily the conservative asset allocation, but if you get the equitylike returns, lower risk, the risk-adjusted return attractiveness of low-vol is still there.

Bryan: Now, one of the points you mentioned in the panel was that it's really important to be intentional about the risk that you take and sometimes if you don't control the portfolio with a low volatility strategy and some other factor strategies, you may get unintended risk in the portfolio. One of the risks that Morningstar research suggests might be there with defensive equity portfolios is that these types of stocks might be a little bit more sensitive to changing interest rates than other areas of the market, do they either the sector tilts that the strategy may have, or the very nature of defensive stocks may tend to underperform in environments when rates are rising. Is this a risk that you are concerned about at all?

Nielson: So, again, I'll admit, it is something I'm thinking about and somewhat concerned about because rates have been extremely low, practically at historic lows, and they have been rising. Again, we have done a lot of research in this space. My team has done a lot of research to look at rising interest rates and how that affects different factors. We are talking about low-vol right now. It can also impact dividend strategies. When rates rise, equity strategies, the income becomes less attractive because you can get the yield from the bonds. Interestingly though, low-vol strategies are even, at least in our work, seem to be even more sensitive to rising rates. The question there is, what's the fundamental reason, what's the intuition.

I think to put it simply, when rates are rising, it's because bond prices are going down. It's just the way the bond math works. When bond prices are going down, it's because they are being sold and that's typically because we are going into a risk-on environment. In a risk-on environment, high-vol does well and not low-vol. To me, that's the intuitive explanation for why that's the case. Our research has shown it's the case. It's something I'm thinking about.

Having said all that, there's ways to mitigate the risk. One of them is mitigating the sector overweights and underweights as we talked about. If you control for big sector bets, that does a lot to mitigate the interest-rate risk which is what we do in FDLO. It's also what we do in FDRR, which is our Dividend ETF for rising rates. Sector neutralization there to protect from the rising rate environment. That product actually we're doing something even a little more different, which is, including another factor, which accounts for every stock's correlation with changes in rates.

Bryan: Right. So, reining in those sector tilts can help prevent you from holding up on to utilities and REITs which maybe more sensitive to rates than other …

Nielson: That's exactly right, yes.

Bryan: Great. Interesting insights as always. Thanks for joining us.