Christine Benz: Some investors are clearly using ETFs as trading vehicles, but what about advisors who seem to be building portfolios consisting of ETFs and they're kind of using them as long-term building blocks. That isn't a negative exercise, right?

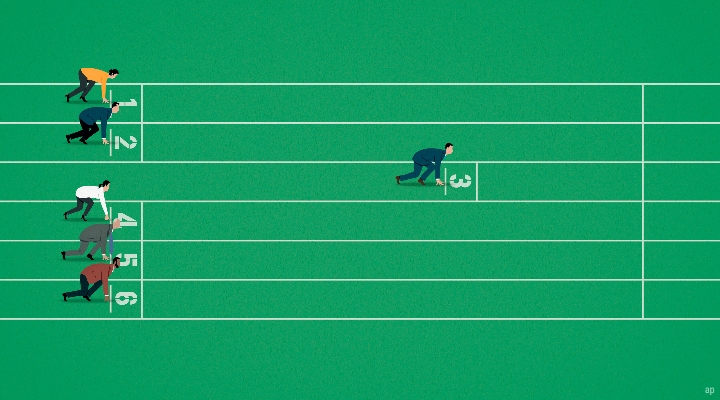

Bogle: Anything that involves trading of mutual funds or for that matter, trading in stocks is a negative by definition. All traders capture the market return before cost. They're obviously equal after cost because they're trading with one another. So, the more you trade, the less your return, the less return you earn relative to the market. I don't know why people can't understand this.

If advisors or investors were prescient and could tell you that healthcare is going to do better than technology and vice versa with any accuracy at all, that would be great, but they can't. They cannot do that because when you're buying technology stocks, somebody else is--I hope you're sitting down for this, Christine--somebody else is selling them.

So, basically it's a closed, relative return matter among all investors in any given class of stocks. So, your advisor or you may be able to beat the system for a while, but you're not going to beat it forever. I hope I don't get myself into too much trouble here, but I am opposed to any significant amount of trading. Just because it costs money.

Benz: Right, right. But for advisors who are building buy-and-hold portfolios that happen to consist of ETFs, that's OK, right?

Bogle: Sure, and if you look at Betterment for example, you'll see their portfolios are laced with Vanguard 500, Vanguard Total Stock Market Index Fund, and some of the others that do not have high turnover. So, I think they're doing the right thing. They trade a little bit at the margin and they like to do this tax-loss carryforward kind of thing, which I don't think is of very large value because the amount of tax-loss carryforward you can have is very, very small.

Benz: Today, certainly.

Bogle: Well, it's about $3,000 a year is the maximum you can deduct. Something like that.